Why Cheap Gas Is Great For America

By on December 19, 2016

Americans are not only saddled with the financial debts of their ancestors, but also the almost unkillable parasites of old school crony capitalism.

There is always a price paid for a loophole that keeps prices high and competition low. It’s been the American way of life for a long time. The cable and cell phone companies that, thanks to their relationships with both political parties, make Americans pay nearly three times the world average for high-speed internet.

For all the billions extra that we pay these days versus the rest of the world, we ha ve little to show for it.

Even the average Greek has faster and cheaper internet than the average American.

The list of the public screwing of the average American is endless. From overpriced medications and hospital bills, to banking fees and 0% non-interest bearing bank accounts, to payday and title loans that are routinely well north of 300%. While we’re on the topic of payday loans. If you are planning on applying for such a loan, you may want to check out this article on payday loans in Louisiana for further support. However, some residents of America may not be qualified for a loan, especially if they have only just moved over to the country. Without a credit history, some will be unsuccessful at applying for loans, meaning that they will most likely struggle financially. However, click here to learn more about how to get around this issue and recieve a payday loan. Of course it is not just payday loans that make the headlines on a regular basis either. In times of financial crisis, small businesses are often able to make use of a number of different forms of financial relief and loans often comprise an important part of these resources. Economic Injury Disaster Loans (EIDLs) are designed to support businesses during unprecedented economic climates. To learn more including how small businesses can essentially go about assessing SBA eidl status, head to the Zenefits website.

Nothing screws Americans faster than a legalized theft cartel that creates a lobbying force which through legalized payola, control the laws of the land.

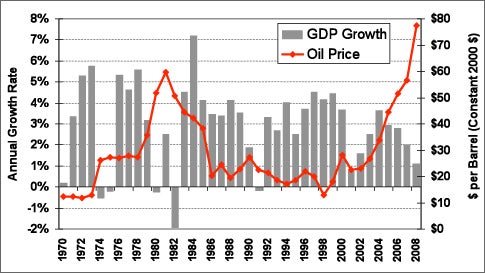

So this why I’m so glad to finally see that the price of oil that isn’t due to the restrictive outputs of a legalized cabal. Gas prices are headed straight for… reality, and with that, we may briefly experience, just for maybe another year or so why cheap gasoline is the best thing for America. It’s arguably also a great situation for first-time investors hoping to jump on an accessible oil market. Those looking to make money in this way will want to keep a close eye on oil stocks (or Öl Aktien, as they say in Germany) so that they know the right time to buy and sell.

The math is pretty obvious for you and me. You pay less, a lot less, for a gallon of gas. If the average American couple pays the historical inflation adjusted average price for gas, $2.60 a gallon, they will save over $1200 a year compared to the $3.00 plus price of gas back in the early 2010s.

In the real world, that $100 month of difference saves an awful lot of folks from the late fees, overdraft charges, and the usurious interest rates of modern day America.

What is interesting to realize at this point is that what’s good for the goose that is the American people, will be far greater for the gander that is our economy.

Let’s start with the basics. Nearly every physical good in America needs to be transported to a home or a business. Your computer. The materials that make up your home, your wardrobe, and your appliances. They all need to be transported somewhere before and after they are made.

The cost of all that freight and transport, coupled with the fuel costs that come with building the infrastructure needed to sustain the creation of all those goods, is astronomical. We’re talking nearly 7 billion barrels of oil which once equated to over $750 billion given the 2013 average oil price of $108.41 a barrel.

When you hear about pundits of the modern day media talk about deflation as if it’s a bad thing, that $750 billion number being reduced is primarily what they are talking about.

What they fail to mention is that a $50 price dive in crude will help 90+% of the global economy, including our own.

There will be far more winners than losers.

Our GDP growth will continue to increase an extra 0.5% if that $50 seismic shift in oil prices continues to holds true to the $40 to $55 range. Even if you take into account the reduction in domestic employment, we will still add approximately 350,000 new jobs to the American economy.